Just when the entire world has started clamouring about the new book on inequality by French economist Thomas Piketty, it becomes essential to mention a UNDP report on the same subject that was released in early 2014. Entitled: Humanity divided: Confronting inequality in Developing Countries, the UNDP report claims that the richest one percent of the world population owns about 40 percent of the world's assets, while the bottom half owns no more than one percent. It warns that inequality could shake the foundations of development, and social and domestic peace. Among other things, the social impacts of inequality include unemployment, violence, crime, humiliation, and deterioration of human capital and social exclusion, refers the report. (Please see the links below).

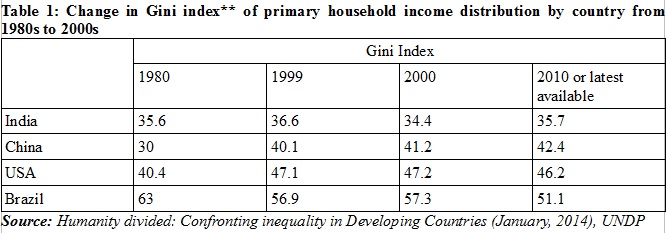

The report has stated that in populous countries like India and China, household income inequality is rising. The Gini index of primary income distribution* in India rose from 33.0 in early 1990s to 35.7 in late 2000s. Similarly, Gini index of secondary income distribution* rose from 31.4 in early 1990s to 34.0 in late 2000s. (Please see table 1 below for details).

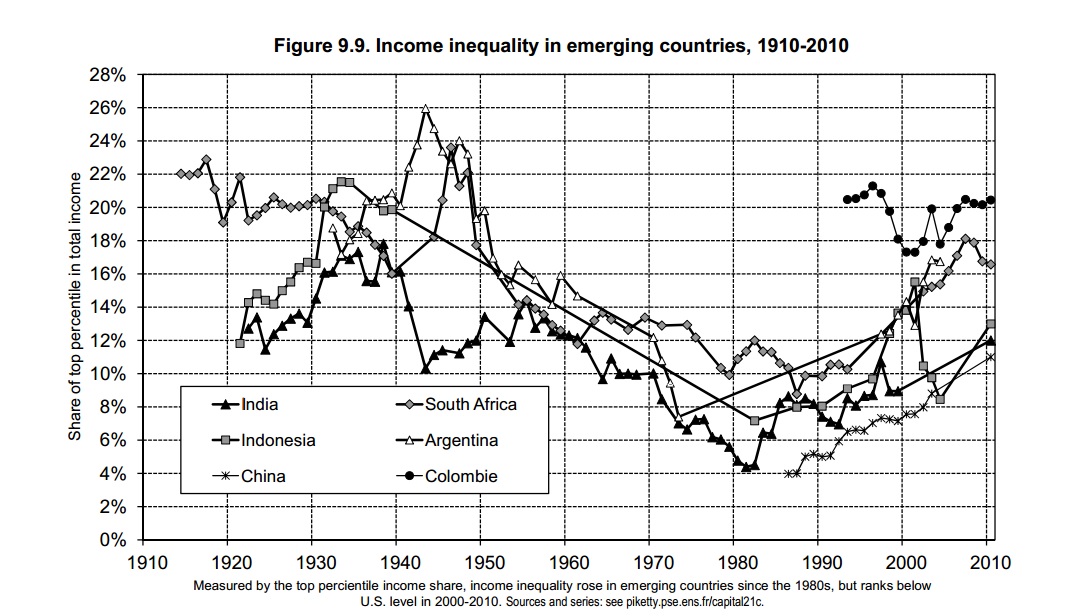

Using the data provided by Abhijit Banerjee and Thomas Piketty (2010) in a study, the UNDP report tells that the richest 1 percent's income share witnessed a rise between 1990 and 1999 in India (see box 3.2, page 86 of the original UNDP report). A figure (see below) from Piketty's recent book entitled: Capital in the 21st century shows that the super rich (top 1 percent) in India owned 8-12 percent of total income in the recent years.

Source: Capital in the 21st century, Harvard University Press, March 2014,

http://piketty.pse.ens.fr/files/capital21c/en/Piketty2014FiguresTables.pdf

Although Piketty (2014) concentrates mainly on high end of the distribution in his latest book, the report by UNDP focuses on both high and low end of the same.

The role of Indian government in promoting “faster, sustainable and more inclusive growth” relying on decent employment during the 12th Five Year Plan has been stated in the UNDP report. It is said that India has started experimenting with small and medium enterprise (SMEs) financing through central bank mechanisms along with special public funds to stimulate and guarantee bank loans linked to their business plans. Since land reforms are problematic, the report emphasizes on improved access to infrastructure, including physical and social infrastructure so as to improve agricultural productivity. The report observes the positive impacts of Mahatma Gandhi National Rural Employment Guarantee Act (MGNREGA) such as increasing rural wages, reducing distress migration, improving infrastructure, reducing unemployment and underemployment, encouraging agricultural productivity and reducing malnutrition.

Discussing the merits and demerits associated with various types of subsidies, the report says that total expense on food subsidies in India constituted US$12.4 billion, or 1 percent of the GDP as compared to 3 percent directed to education in 2009 (Jha et al., 2011). On gender equality, the report informs that the reform of inheritance laws in India, which granted women the right to inherit or own land or capital property through amendments to the Hindu Succession Act, increased women’s land inheritance, but also improved their control over economic resources in the household and their intra-household bargaining power. Quotas as part of affirmative action policies to promote the employment of scheduled castes and tribes in the public sector is also discussed in the report.

According to the UNDP report, a significant majority of households in developing countries – more than three-quarter of entire humanity – are living today in societies where income is more unequally distributed than it was in the 1990s. Although redistribution remains crucial to reducing inequality, the report calls for a shift towards a more inclusive pattern of growth, one that raises the incomes of poor and low-income households faster than average in order to sustainably reduce inequality, key to the post-2015 development agenda.

The report has identified the main drivers of inequality, namely—a. Inadequately regulated financial integration and trade liberalization processes, whose benefits have been distributed very unequally across and within countries; b. Domestic policy choices, such as interventions that weakened labour market institutions or resulted in a downsizing of public investments in critical sectors like health, education and social protection; c. Various economic, social and cultural barriers hindering the political participation of various segments of the population; and d. Discriminatory attitudes and policies that are marginalizing people on the basis of gender or other cultural constructs such as ethnicity or religious affiliation drive many intergroup inequalities.

Incidentally, the world owes a lot to the managing director of the International Monetary Fund (IMF) Christine Lagarde who conjured up everyone's interest on inequality. While delivering the Richard Dimbleby Lecture in London on 3rd February this year, she paid special attention to inequality as a leading cause for global instability. (Please see the link of her lecture below).

The key messages of the UNDP report entitled: Humanity divided: Confronting inequality in Developing Countries (January, 2014) are as follows:

-

Evidence shows that, beyond a certain threshold, inequality harms growth and poverty reduction, the quality of relations in the public and political spheres of life and individuals’ sense of fulfilment and self-worth.

Note:

* The analysis of the trends in income inequality has been focused on the distribution of income between households in an economy. One can interpret household income distribution in three ways (van der Hoeven, 2011):

a. Primary income distribution: the distribution of household incomes consisting of the (sometimes cumulated) different factor incomes in each household before taxes and subsidies as determined by markets and market institutions

b. Secondary income distribution: the distribution of household incomes after deduction of taxes and inclusion of transfer payments (i.e., as determined by fiscal policies)

c. Tertiary income distribution: the distribution of household incomes when imputed benefits from public expenditure are added to household income after taxes and subsidies. This interpretation of household income is particularly relevant for developing, emerging and developed countries, as different government services are often provided for free or below market prices.

** Distribution of income across households or individuals in an economy is usually measured using the Gini Index of inequality, which varies between zero and 100, with zero reflecting complete equality and 100 indicating absolute inequality.

References

Humanity divided: Confronting inequality in Developing Countries (January, 2014), UNDP

http://www.undp.org/content/dam/undp/library/Poverty%20Reduction/Inclusive%20development/Humanity%20Divided/HumanityDivided_Full-Report.pdf

http://www.undp.org/content/undp/en/home/librarypage/poverty-reduction/humanity-divided--confronting-inequality-in-developing-countries.html

http://www.undp.org/content/dam/undp/library/Poverty%20Reduction/Inclusive%20development/Humanity%20Divided/HumanityDivided_overview.pdf

Warning of 'humanity divided,' UN urges job creation, inclusive growth strategies, The United Nations, 29 Janury, 2014, http://www.un.org/apps/news/story.asp?NewsID=47039&Cr=inequality&Cr1#.U2wzC9xdHVI

Capital in the 21st century -Thomas Piketty, http://piketty.pse.ens.fr/en/capital21c2

Reading Piketty in India -Martin Ravallion, The Indian Express, 15 May, 2014, http://indianexpress.com/article/opinion/columns/reading-piketty-in-india/99/

Piketty and the Zeitgeist -Dani Rodrik, 13 May, 2014,

http://www.project-syndicate.org/commentary/dani-rodrik-explains-why-capital-in-the-twenty-first-century-has-become-so-successful-in-the-us

Banerjee, A. and T. Piketty (2010). “Top Indian Incomes 1922-2000”, in Atkinson, A. B. and T. Piketty (eds), Top Incomes: A Global Perspective, Oxford University Press, chapter 1, http://global.oup.com/academic/product/top-incomes-9780199286898;jsessionid=C8BCCC3A901A212BDC55B5EAD4FFF2CF?cc=in&lang=en&

Jha, R., R. Gaiha, M. K. Pandey and N. Kaicker (2011). “Food Subsidy, Income Transfer and the Poor: A Comparative Analysis of the Public Distribution System in India’s States”, ASARC Working Paper 2011/16. Canberra: Australia South Asia Research Centre.

A New Multilateralism for the 21st Century: the Richard Dimbleby Lecture By Christine Lagarde, Managing Director, International Monetary Fund, London, February 3, 2014, https://www.imf.org/external/np/speeches/2014/020314.htm

Why We’re in a New Gilded Age-Paul Krugman, The New York Times, 8 May, 2014, http://www.nybooks.com/articles/archives/2014/may/08/thomas-piketty-new-gilded-age/

The Taxation of Wealth-Prabhat Patnaik, People's Democracy, Vol. XXXVIII, No. 18, May 04, 2014 , http://peoplesdemocracy.in/2014/0504_pd/taxation-wealth

The 1 Percent’s Problem by Joseph Stiglitz, 31 2012, Vanity Fair,

http://www.vanityfair.com/politics/2012/05/joseph-stiglitz-the-price-on-inequality

RURAL URBAN GAP SHRINKS BUT INEQUALITY RISES

http://www.im4change.org/news-alerts/rural-urban-gap-shrinks-but-inequality-rises-16499.html

RURAL URBAN DIVIDE: A TALE OF TWO INDIAS

http://www.im4change.org/news-alerts/rural-urban-divide-a-tale-of-two-indias-15424.html